Not known Details About Custom Private Equity Asset Managers

Wiki Article

The Single Strategy To Use For Custom Private Equity Asset Managers

You have actually probably come across the term private equity (PE): spending in firms that are not openly traded. Approximately $11. 7 trillion in properties were managed by private markets in 2022. PE firms seek possibilities to earn returns that are better than what can be attained in public equity markets. There might be a few points you do not recognize about the industry.

Partners at PE companies elevate funds and manage the cash to generate desirable returns for shareholders, usually with an financial investment perspective of in between four and 7 years. Private equity firms have a series of financial investment preferences. Some are stringent investors or easy capitalists entirely reliant on administration to grow the business and create returns.

Due to the fact that the very best gravitate toward the larger offers, the center market is a dramatically underserved market. There are extra vendors than there are extremely skilled and well-positioned money specialists with considerable purchaser networks and resources to manage an offer. The returns of personal equity are usually seen after a few years.

Rumored Buzz on Custom Private Equity Asset Managers

Traveling below the radar of huge international companies, much of these little business usually provide higher-quality customer care and/or niche services and products that are not being supplied by the big empires (https://customprivateequityassetmanage.godaddysites.com/f/unlocking-success-private-equity-firm-and-asset-management-group). Such advantages bring in the interest of exclusive equity companies, as they possess the insights and savvy to manipulate such chances and take the company to the next degree

Exclusive equity capitalists need to have reputable, qualified, and trustworthy management in position. Most managers at profile firms are provided equity and incentive compensation frameworks that reward them for striking their financial targets. Such placement of objectives is typically called for before a deal obtains done. Exclusive equity opportunities are often out of reach for individuals who can not spend millions of bucks, but they shouldn't be.

There are laws, such as restrictions on the aggregate amount of cash and on the number of non-accredited financiers. The exclusive equity business brings in a few of the very best and brightest in business America, including top entertainers from Lot of money 500 companies and elite administration consulting companies. Law firms can also be hiring grounds for personal equity works look at these guys with, as audit and lawful skills are required to complete offers, and deals are very searched for. https://pxhere.com/en/photographer-me/4136672.

Custom Private Equity Asset Managers - Questions

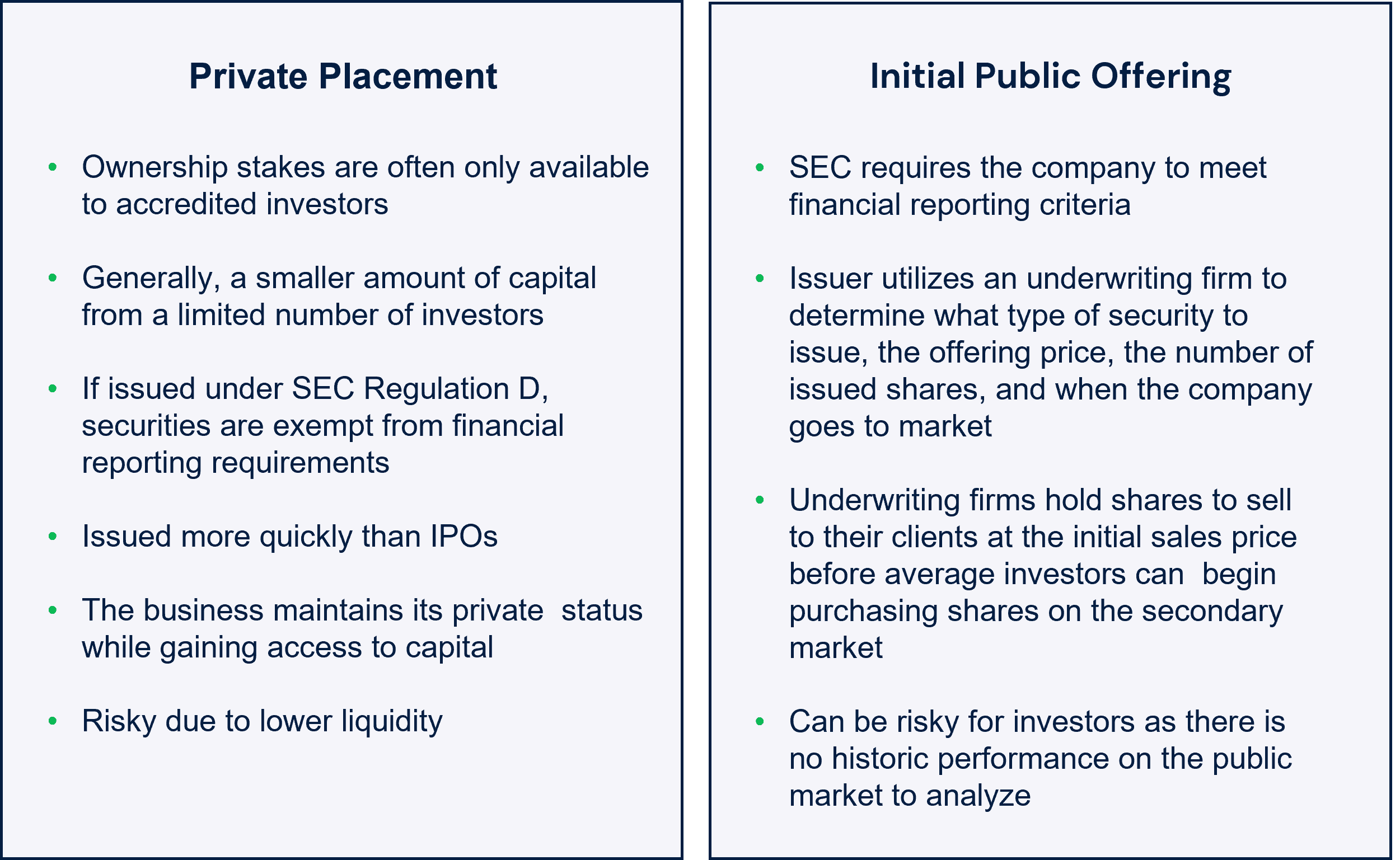

One more downside is the lack of liquidity; once in an exclusive equity deal, it is challenging to leave or market. There is a lack of adaptability. Personal equity also comes with high costs. With funds under administration already in the trillions, exclusive equity firms have become attractive investment cars for rich individuals and establishments.

For decades, the features of private equity have actually made the property course an appealing proposition for those who could get involved. Now that accessibility to personal equity is opening approximately more private capitalists, the untapped capacity is ending up being a fact. The concern to consider is: why should you spend? We'll start with the major debates for purchasing personal equity: Just how and why personal equity returns have historically been more than other possessions on a number of levels, Exactly how consisting of private equity in a profile impacts the risk-return profile, by assisting to branch out against market and intermittent danger, After that, we will certainly detail some vital considerations and risks for exclusive equity capitalists.

When it comes to introducing a new property right into a portfolio, one of the most basic factor to consider is the risk-return account of that asset. Historically, private equity has actually shown returns similar to that of Arising Market Equities and more than all various other standard possession courses. Its reasonably reduced volatility combined with its high returns makes for a compelling risk-return profile.

The Best Strategy To Use For Custom Private Equity Asset Managers

As a matter of fact, private equity fund quartiles have the widest series of returns throughout all alternate property classes - as you can see listed below. Methodology: Internal price of return (IRR) spreads calculated for funds within classic years independently and then averaged out. Average IRR was calculated bytaking the standard of the average IRR for funds within each vintage year.

The impact of adding private equity right into a portfolio is - as always - dependent on the portfolio itself. A Pantheon study from 2015 suggested that consisting of private equity in a profile of pure public equity can unlock 3.

On the other hand, the best private equity companies have accessibility to an even bigger pool of unidentified chances that do not face the exact same analysis, as well as the resources to carry out due persistance on them and recognize which are worth purchasing (Asset Management Group in Texas). Investing at the very beginning indicates greater danger, but also for the companies that do succeed, the fund benefits from greater returns

The Only Guide for Custom Private Equity Asset Managers

Both public and private equity fund managers dedicate to spending a percent of the fund yet there stays a well-trodden issue with aligning rate of interests for public equity fund administration: the 'principal-agent trouble'. When an investor (the 'primary') employs a public fund manager to take control of their resources (as an 'representative') they delegate control to the supervisor while maintaining ownership of the assets.

In the instance of personal equity, the General Partner doesn't just make an administration cost. Exclusive equity funds additionally reduce another type of principal-agent issue.

A public equity capitalist inevitably wants one point - for the monitoring to increase the stock rate and/or pay returns. The financier has little to no control over the decision. We showed over the number of exclusive equity methods - particularly majority buyouts - take control of the operating of the company, ensuring that the lasting worth of the company comes initially, rising the roi over the life of the fund.

Report this wiki page